Rethinking the function of fiat currency

The dollar as a payment rail to move bitcoin through space

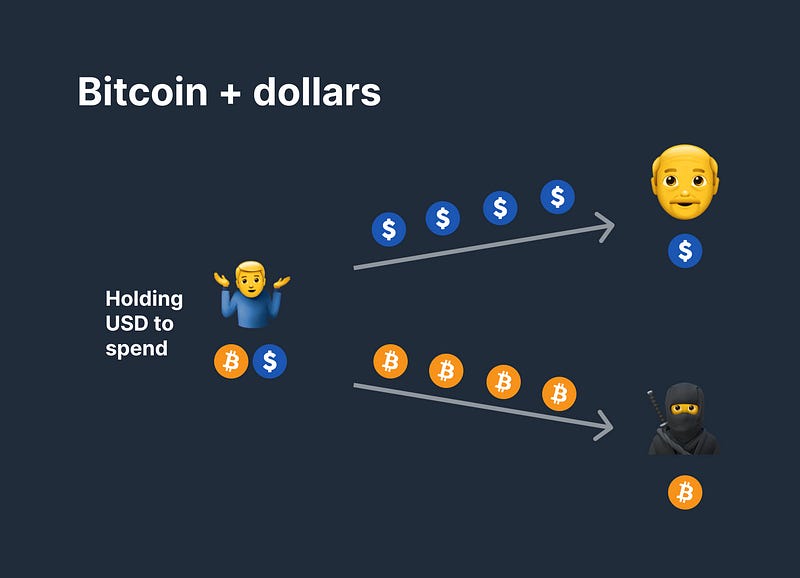

For most of us, the vast majority of our day-to-day expenses require the local fiat currency as a medium of exchange (in my case, the US dollar). This inconvenience leads most bitcoiners to think that they should hold a non-zero USD balance to pay for those expenses. I’m putting forward a thought experiment, a new mental model for the role of fiat currency in the bitcoin layered stack.

🟠 Superior money

On average, every dollar held loses purchasing power while every sat (smallest unit of a bitcoin) held gains purchasing power. Sats can also be sent instantly and without permission from any authority. In other words, bitcoin has superior salability across both time and space compared to fiat currencies.

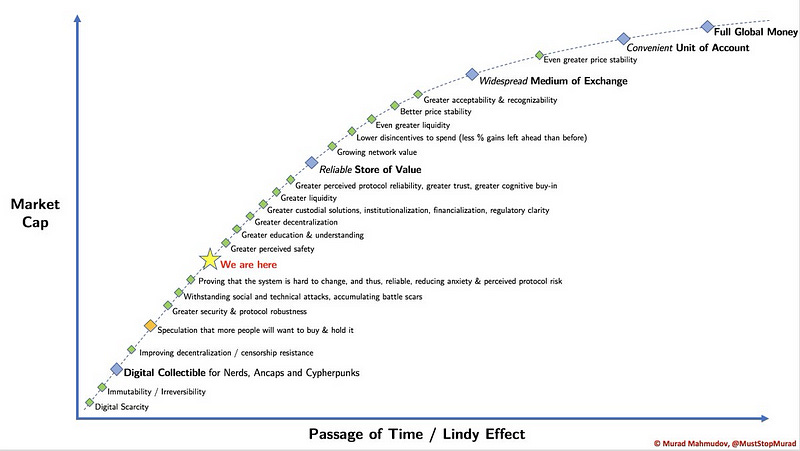

So why don’t merchants accept bitcoin, the superior money, for goods and services? Conventional wisdom on Bitcoin Twitter is that monetary assets go through phases of monetization, from collectible → store of value → medium of exchange → unit of account. The cash (bitcoin) balance of merchants isn’t yet high enough for them to willingly accept bitcoin (barring other incentives, like lower payment processing costs).

Though hyperbitcoinization (the increasing monetization of bitcoin) is accelerating, what is stopping us from front-running this process? An increasing number of individuals living on a bitcoin-only standard need a way to remain interoperable with legacy fiat payment networks, while continuing to side-step wealth debasement and minimize financial surveillance.

With that context, what if we re-thought the function of fiat currency in the lives of bitcoiners?

⚡️ Payment rails

The dollar and bitcoin are both monetary assets that can be moved through space with the help of payment rails. We can move the US dollar around with the help of payment rails like the PayPal network, the ACH network, or transfer of physical bills. Sats on the bitcoin network can be moved over bitcoin-native payment rails (on-chain, lightning, sidechains).

What if, instead of treating the dollar as the primary medium of exchange and bitcoin as the store of value, we treated bitcoin as our base money and the dollar as one of many payment rails to move that money (bitcoin) through space?

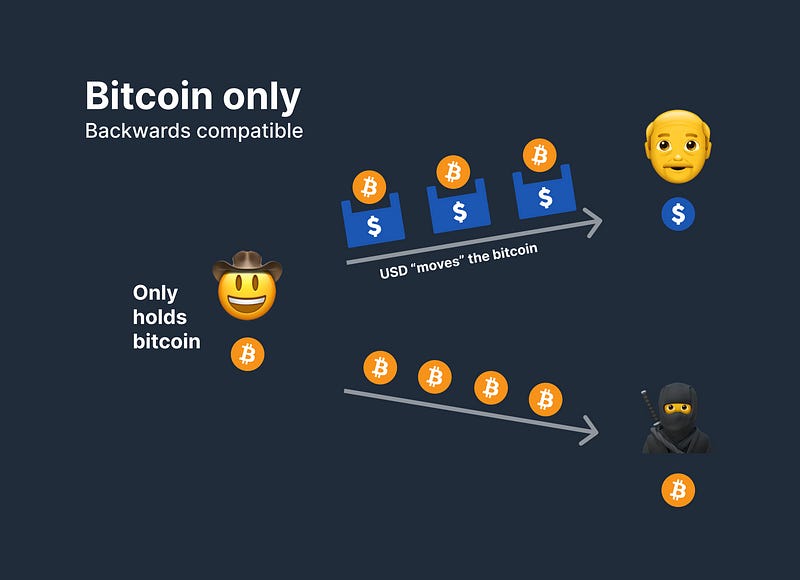

🤝 Backwards compatibility

There’s a lot of discussion these days about using the bitcoin network as an efficient payment rail to move US dollars. What if we did the reverse? To be interoperable with the legacy system, what if we thought of the dollar as a legacy payment rail to move bitcoin to those who haven’t upgraded to superior, bitcoin-native payment rails yet?

And so, my claim is that fiat currencies should not be assets to hold on your balance sheet, rather they are legacy payment rail to move your bitcoin through space.

The USD is a legacy payment rail to move bitcoin through space.

Whether you are paying your mortgage bill or buying a cup of coffee, you and your counterparty have a choice to use bitcoin-native payment rails (superior), or legacy fiat payment rails (inferior). This way, your base money is bitcoin, but you are fully interoperable with the legacy fiat payment rails.

🤔 Merchant adoption?

Because bitcoin-native payment rails are far superior to legacy fiat payment rails, we all have an incentive to want merchants to accept bitcoin directly. That said — many bitcoiners are not a fan of evangelizing bitcoin payments at every bar they go to. Instead, these bitcoiners can hold superior money (bitcoin) while still being interoperable with every payment network, whether bitcoin-native or fiat-native.

In the meantime, we have bitcoiners like Jack Mallers (Strike), Michael Atwood (Oshi), and BTCPay who are building the tools to help merchants upgrade to the superior payments network. Entrepreneurs and passionate local community members have a strong incentive to drive adoption.

If we all individually upgrade our personal balance sheets and live on a bitcoin standard (savings + payments), we upgrade the world.

Bitcoin moving over fiat rails > fiat moving over bitcoin rails

🤠 What are you waiting for, anon?

As Brian mentions in this tweet, there’s no need to wait for bitcoin to be declared legal tender by governments to use it as a medium of exchange. On average, the dollar loses purchasing power and bitcoin gains purchasing power. A combination of privacy-preserving payment rails + automated tax optimization strategies means that the reason to hold fiat currencies is shrinking.

As Heavily Armed Clown has noted in the past: “Clown world is funded by deficit spending, not taxes.” There’s no need to wait for hyperbitcoinization my friends. Starve the beast.